Retirement

Pepperdine has partnered with Transamerica to serve as its recordkeeper for employee retirement savings plans. To create or access your online retirement account, visit our Transamerica Retirement Plan website.

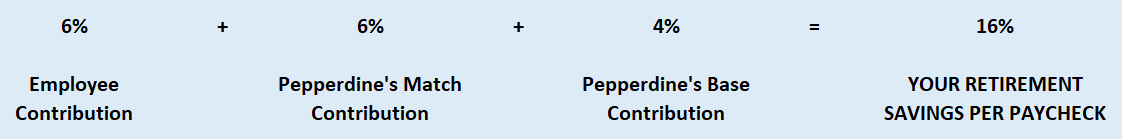

403(b) Retirement Savings Plan

Pepperdine offers employees a 403(b) account to defer their compensation to for retirement planning purposes. A 403(b) account is similar to a 401k, but a 403(b) is available for non-profit organizations. Contributions are fully vested at the time of deposit, and employees can change their contributions through their Transamerica online account at any time.

For all 403(b) plan details, please review the Retirement Summary Plan Description.

Retiree Health VEBA Plan

Pepperdine has partnered with BPAS to provide a Retiree Health Plan intended to assist employees in meeting their healthcare expenses and those of their family during their retirement years. Individuals employed in an eligible position at 30 hours or more per week (.75 FTE) may become eligible to participate in this benefit during the course of their employment.

For all Retiree Health Plan details, please review the Retiree Health Summary Plan Description.

Retirement Plan Committee

- Joseph Fritsch, Professor, Seaver College

- Robert Lee, Associate Professor, Seaver College

- Pete Peterson, Dean, School of Public Policy

- Greg Ramirez (co-Chair), Chief Financial Officer

- Nicolle Taylor (co-Chair), Senior Vice President and Chief Operating Officer